Individual Health Insurance Policies: State-Regulated Coverage Options

Understand individual health insurance policies

Individual health insurance policies provide coverage for people who don’t have access to employer sponsor health plans or government programs like Medicare or Medicaid. These policies are mainly regulated at the state level, though federal laws like the Affordable Care Act (ACA) establish minimum standards that apply nationally.

State insurance departments oversee these policies to ensure they meet both federal requirements and additional state specific regulations. This oversight create variations in coverage options, consumer protections, and pricing from one state to another.

Four common types of state regulate individual health insurance policies

1. Qualified health plans (qHPS))

Qualified health plans represent the standard individual health insurance policies available through state base or federally facilitate health insurance marketplaces establish under the ACA.

Key features:

- Must cover essential health benefits as define by federal law

- Can not deny coverage base on pre-existing conditions

- Premium rates can exclusively vary base on age, geographic location, tobacco use, and family size

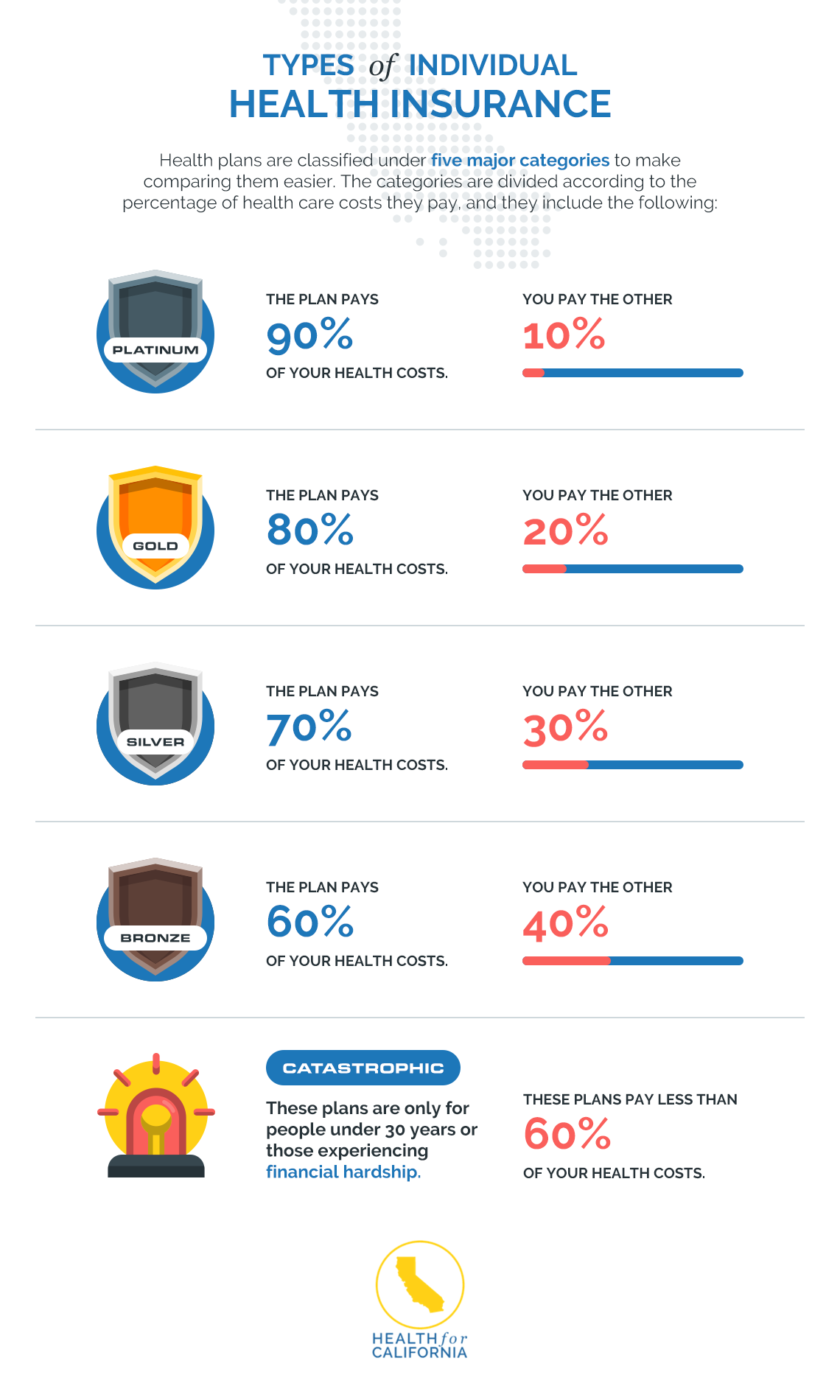

- Available in metal tiers (bronze, silver, gold, platinum )represent different levels of cost sharing

- May qualify for premium tax credits and cost sharing reductions depend on income

State regulation aspects:

- States can define their own essential health benefits benchmark plans

- States may impose additional benefit requirements beyond federal minimums

- Some states operate their own marketplaces with unique enrollment periods and verification processes

- Rate review processes vary by state, with some have stricter controls on premium increases

For example, California’s marketplace (covered cCalifornia)has ststandardizedenefit designs across all plans, while other states allow more variation in plan structure. Massachusetts require more comprehensive coverage than federal minimums, include broader prescription drug coverage.

2. Short term health insurance plans

Short term health insurance policies provide temporary coverage for individuals during transitions between jobs, waiting periods for other coverage, or other temporary gaps in insurance.

Key features:

- Design for temporary coverage needs

- Mostly less expensive than HPS

- Not require covering all essential health benefits

- Can exclude coverage for pre-existing conditions

- Not eligible for premium tax credits

State regulation aspects:

- Duration limits vary importantly by state

- Some states prohibit short term plans solely

- States may impose benefit requirements not mandate federally

- Medical underwriting restrictions differ across states

The variation in short term plan regulations is specially notable. While federal rules allow these plans to last upwards to 12 months with renewals for up to 36 months total, many states impose stricter limits. For instance, Colorado limit short term plans to six months with no renewals, while states like California, Massachusetts, New York, and New Jersey efficaciously prohibit these plans entirely through strict regulations.

3. Catastrophic health insurance plans

Catastrophic health insurance plans offer protection against worst case scenarios with high deductibles and lower premiums, design mainly for younger, healthier individuals.

Source: bimabandhu.in

Key features:

- High deductibles with lower monthly premiums

- Cover essential health benefits after deductible is meet

- Provide preventive services and limited primary care visits before deductible

- Mostly limit to individuals under 30 or those with hardship exemptions

- Not eligible for premium tax credits

State regulation aspects:

- States may establish additional eligibility criteria

- Some states require catastrophic plans to cover additional benefits

- Network adequacy requirements vary by state

- States may impose different marketing and disclosure requirements

Catastrophic plans represent an interesting intersection of federal standards and state regulation. While the basic structure is defined federally, states likeRhode Islandd andVermontt haveimplementedt additional consumer protections for catastrophic plan enrollees, include enhance disclosure requirements and stricter network adequacy standards.

4. Health care sharing ministries (hhosts)

Health care sharing ministries are not technically insurance but function as alternatives for individuals who share similar religious or ethical beliefs. Members contribute monthly shares that help pay for other members’ medical expenses.

Key features:

- Not insurance but function likewise for members

- Broadly require adherence to specific religious or ethical principles

- Monthly contributions oftentimes lower than traditional insurance premiums

- Not require covering essential health benefits

- Can exclude coverage for pre-existing conditions and certain treatments

State regulation aspects:

- Regulatory oversight vary dramatically by state

- Some states exempt hosts from insurance regulations while others impose restrictions

- Disclosure requirements differ across states

- Consumer protection mechanisms vary wide

Health care sharing ministries exist in a regulatory gray area in many states. While most states provide some form of exemption from insurance regulations, the degree of oversight varies. States like Kentucky and Florida have specific statutes recognize hosts, while others like Washington have imposed stricter disclosure requirements to ensure consumers understand these are not insurance products.

How state regulation impact individual health insurance

Premium rate setting and review

States play a crucial role in oversee how insurance companies set premium rates for individual market plans. The degree of rate regulation vary importantly:

- Prior approval states: Insurers must receive regulatory approval before implement rate changes (e.g., nNew York cCalifornia)

- File and use states: Insurers file rates but can implement them without explicit approval (e.g., tTexas)

- Use and file states: Insurers can implement rates directly but must file them later (e.g., aAlabama)

This regulatory variation create significant differences in premium stability across states. States with rigorous rate review processes typically experience more moderate premium increases over time.

Network adequacy requirements

States establish standards for insurance networks to ensure policyholders have reasonable access to healthcare providers:

- Provider to enrollee ratios

- Maximum travel times and distances to providers

- Wait time standards for appointments

- Access to specialists and essential community providers

States like New Jersey and Washington have implemented peculiarly robust network adequacy standards, while others defer more to insurer discretion. These differences straightaway impact consumers’ ability to access care within their insurance networks.

Benefit mandates

While the ACA establish essential health benefits that all qualified health plans must cover, states can require additional benefits:

- Specific treatments or procedures

- Coverage for particular provider types

- Enhanced prescription drug coverage

- Additional preventive services

For example, Illinois require coverage for fertility treatments, California mandate acupuncture coverage, and many states have specific autism treatment requirements. These mandate enhance coverage but can besides increase premiums.

Consumer protection measures

States implement various consumer protection measures that exceed federal requirements:

- Marketing restrictions

- Enhance disclosure requirements

- Complaint resolution process

- Insurer financial solvency monitoring

Massachusetts and California are oftentimes cited as have especially strong consumer protection frameworks for health insurance purchasers, include standardized benefit designs that make plan comparison easier.

Choose the right individual health insurance policy

Assess your healthcare needs

Before select a policy, consider your specific healthcare requirements:

- Regular prescription medications

- Ongoing treatment for chronic conditions

- Anticipated medical procedures

- Preferred doctors and hospitals

- Family planning needs

Different policy types offer vary levels of coverage for these needs, and state regulations affect which options are available to you.

Understand total costs

When compare policies, look beyond monthly premiums to understand the total potential cost:

- Deductibles

- Copayments and coinsurance

- Out of pocket maximums

- Network restrictions and potential out-of-network costs

- Prescription drug formularies and tiers

State regulations on cost sharing and rate setting direct impact these factors. Some states have implemented additional affordability standards beyond federal requirements.

Checking provider networks

Verify that your preferred healthcare providers participate in the plan’s network:

Source: teronga.com

- Primary care physicians

- Specialists you presently see

- Local hospitals

- Urgent care facilities

- Mental health providers

Network adequacy regulations vary by state, affect the breadth and accessibility of provider networks available to you.

Evaluating coverage limitations

Be aware of potential coverage limitations and exclusions:

- Pre-existing condition waiting periods ( f( non aca ACAns ) )

- Specific treatment exclusions

- Referral requirements

- Prior authorization policies

- Annual or lifetime benefit caps (for non aACAplans )

State regulations oftentimes determine what limitations insurers can impose beyond federal standards.

Navigate state specific resources and assistance

State insurance department resources

Each state’s insurance department offer resources to help consumers understand their options:

- Plan comparison tools

- Consumer guides to health insurance

- Complaint filing systems

- Rate filing information

- Insurance company financial information

These resources vary in comprehensiveness and user-friendliness across states.

State base marketplace assistance

States with their own health insurance marketplaces typically offer more localize assistance:

- In person enrollment assistance

- Local helplines

- Community base navigators

- State specific enrollment periods and special enrollment opportunities

States like Washington, California, and Massachusetts have invested intemperately in consumer assistance programs that go beyond federal marketplace support.

Consumer assistance programs

Many states operate consumer assistance programs to help with insurance issues:

- Claim denials and appeals

- Billing disputes

- Coverage questions

- Eligibility for subsidies or state programs

The availability and scope of these programs depend on state funding and priorities.

Conclusion

Individual health insurance policies regulate by states offer various coverage options with significant variations in benefits, costs, and consumer protections. Understand the four main types of policies — qualified health plans, short term health insurance, catastrophic health insurance, and health care sharing ministries — along with how state regulations affect them is essential for make informed healthcare coverage decisions.

The complex interplay between federal minimum standards and state specific regulations create a diverse landscape of options across the country. By cautiously assess your healthcare needs and understand the regulatory environment in your state, you can select the individual health insurance policy that best balance coverage, cost, and access to care for your specific situation.

Remember that state insurance departments, marketplace assistance programs, and consumer advocacy organizations can provide valuable guidance as you navigate these choices. Take advantage of these resources can help ensure you select coverage that provide appropriate protection for your health and financial well-being.